In Pflugerville, non-traditional loan options like secured loans backed by vehicle valuation and debt consolidation provide flexible, affordable solutions with lower interest rates. Refinancing and peer-to-peer lending platforms offer further alternatives to traditional auto title loans. Houston Title Loans accept personal assets like boats as collateral, appealing to those avoiding stress of conventional processes. Exploring diverse options beyond Pflugerville auto title loans offers tailored terms and conditions.

In Pflugerville, auto title loans have long been a go-to option for quick cash. However, there’s a growing need to explore alternatives that offer better terms and conditions. This article delves into non-traditional loan options specific to Pflugerville, helping residents understand diverse funding sources for their vehicles. We navigate debt solutions beyond auto title loans, empowering folks to make informed choices and find suitable alternatives to these high-interest loans.

- Exploring Non-Traditional Loan Options in Pflugerville

- Understanding Alternative Funding Sources for Cars

- Navigating Debt Solutions Beyond Auto Title Loans

Exploring Non-Traditional Loan Options in Pflugerville

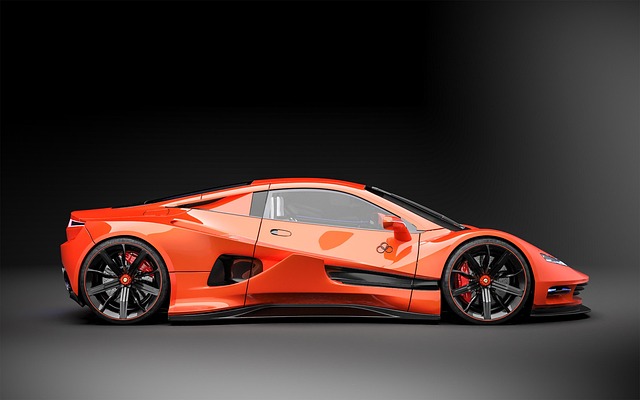

In Pflugerville, exploring non-traditional loan options can open doors to more flexible and affordable financial solutions. While Pflugerville auto title loans are a common choice for borrowers, it’s important to consider alternatives that cater to diverse financial needs. One such option is using the vehicle valuation as collateral for a secured loan, which often comes with lower interest rates compared to traditional auto title loans. This approach allows individuals to access funds without giving up complete ownership of their vehicles, providing some financial breathing room.

Additionally, debt consolidation stands out as another viable alternative in Pflugerville. By combining multiple high-interest debts into a single loan with a lower interest rate, residents can streamline their repayment process and potentially save money on interest payments. This method not only simplifies financial management but also makes it easier to stick to a repayment plan, offering a more sustainable path towards debt elimination.

Understanding Alternative Funding Sources for Cars

When considering funding options for a car, it’s essential to look beyond traditional Pflugerville auto title loans. There are several alternative sources that offer flexible and sometimes more affordable solutions. These alternatives cater to various financial needs and circumstances, ensuring that vehicle owners have diverse choices.

One such option is exploring loan refinancing. This involves taking out a new loan with different terms and conditions, potentially securing a lower interest rate. It can be beneficial for those who initially took out a loan with less-favorable terms but now have improved credit scores or financial stability. Refinancing allows them to pay off the existing loan faster and save on interest expenses over the long term. Additionally, there are peer-to-peer lending platforms that connect borrowers directly with lenders, offering competitive rates and customized Loan Terms based on individual profiles. These alternatives provide a chance for better financial control and savings, especially when compared to the fixed rates and collateral requirements often associated with Pflugerville auto title loans.

Navigating Debt Solutions Beyond Auto Title Loans

In Pflugerville, residents often explore various debt solutions to manage their financial obligations, and one option that has gained attention is Houston Title Loans. Unlike traditional Pflugerville auto title loans, which use a vehicle’s title as collateral, Houston Title Loans offer an alternative approach by leveraging personal assets like boats or other recreational vehicles. This strategy can be particularly appealing for those seeking quick funding without the stress of conventional loan processes.

By considering Boat Title Loans or exploring other creative debt solutions, individuals can navigate their financial challenges differently. These alternatives provide a fresh perspective, ensuring that residents have options beyond the conventional Pflugerville auto title loans. With each unique solution, there are varying terms and conditions to consider, allowing individuals to choose what best suits their needs while efficiently managing their debts.

In exploring alternatives to Pflugerville auto title loans, it’s clear that understanding various funding sources can empower individuals to make informed decisions. By delving into non-traditional loan options and debt solutions, residents of Pflugerville can navigate financial challenges with fresh perspectives. Whether through innovative funding sources or strategic debt management, there are always better paths to consider, offering both short-term relief and long-term financial health.