Pflugerville auto title loans offer fast financial relief for those needing emergency cash or debt refinancing. The process involves applying, sharing vehicle and financial info, and lenders assessing eligibility based on factors like car condition, credit history, and income verification. Upon approval, the lender secures the loan against the car's title, with repayment aligned to ownership transfer. The entire process is designed to be efficient, typically taking 30 minutes to a few hours from application to funding.

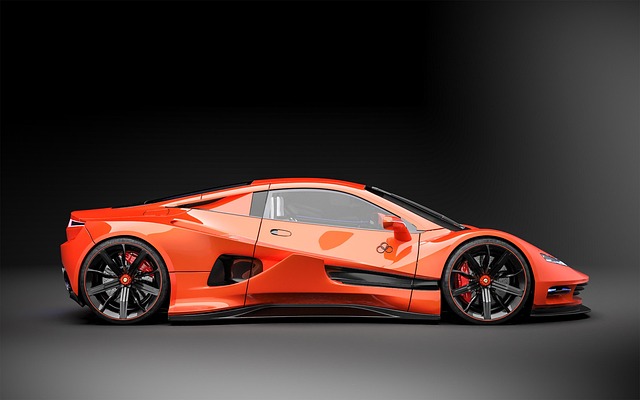

Looking for a quick cash solution in Pflugerville? Pflugerville auto title loans offer a unique opportunity to borrow against the equity of your vehicle. This article demystifies the process, guiding you through each step from understanding the basics to factoring in processing times. Learn what influences loan speed and what to expect from application to approval. Discover how these loans can provide fast access to funds while ensuring your vehicle remains in your possession.

- Understanding the Process of Pflugerville Auto Title Loans

- Factors Affecting Loan Processing Time

- What to Expect: From Application to Approval

Understanding the Process of Pflugerville Auto Title Loans

Pflugerville auto title loans are a quick solution for those needing emergency funds or looking to refinance existing debt. Understanding the process is key to navigating this type of secured loan. It begins with the borrower submitting an application, providing details about their vehicle and financial situation. Lenders assess the value of the car and its condition, among other factors, to determine loan eligibility and terms.

Once approved, the lender secures the loan against the vehicle’s title, ensuring repayment is tied to ownership. This streamlines the process compared to traditional bank loans. With a clear understanding of the terms and conditions, borrowers can access their emergency funds promptly while maintaining control over their asset.

Factors Affecting Loan Processing Time

When applying for Pflugerville auto title loans, several factors influence the processing time. Firstly, the condition and value of your vehicle play a significant role. Lenders will assess your car to determine its worth, which directly impacts the loan amount you qualify for. Additionally, the state of your title—whether it’s clean or encumbered by existing loans—speeds up or slows down the process. A clear title allows for quicker approval and funding.

Other considerations include your credit history and income verification. Lenders will want to assess your financial stability, which is crucial for evaluating repayment ability. Flexible payments options are often available with Houston title loans, but these may take slightly longer to set up compared to traditional loans. Nonetheless, the entire process aims to be efficient, ensuring that you receive your funds as swiftly as possible while adhering to necessary legal and security checks.

What to Expect: From Application to Approval

When considering a Pflugerville auto title loan, understanding the process from application to approval is crucial. The journey begins with filling out an online or in-person application, providing details about your vehicle and financial information. After submission, a lender will review your application, verifying your vehicle ownership and assessing your creditworthiness based on loan requirements such as income and debt-to-income ratio. This step is essential to determine the value of your vehicle and the loan amount you qualify for.

If approved, the process accelerates with the lender inspecting your vehicle to ensure its condition aligns with the expected standards. Once validated, they’ll process the direct deposit of the approved loan amount into your bank account, making it a swift and convenient financing option. The entire process, from application to approval, typically takes 30 minutes to a few hours, depending on the lender and the complexity of your situation.

Pflugerville auto title loans offer a swift financial solution for those in need. The process, from understanding your options to receiving approval, typically takes just a few days. Several factors, such as the value of your vehicle and your ability to repay, influence processing time. By providing accurate information and meeting basic requirements, you can streamline the application process. Expect a straightforward journey towards securing the funds you need, making Pflugerville auto title loans a convenient choice for immediate financial assistance.