Pflugerville auto title loans provide quick cash using a vehicle's title as collateral, prioritizing car equity over credit score. Key factors when selecting a lender include interest rates, repayment periods, fee transparency, and flexible payment plans. Reputable local lenders like Lender A and Lender B offer swift approvals, online applications, competitive rates, and tailored terms for Pflugerville drivers with urgent funding needs.

Looking for a fast and flexible financing option in Pflugerville? Pflugerville auto title loans could be the solution. This article demystifies these secured loans, breaking down the basics for informed decision-making. We guide you through crucial factors to consider when choosing a lender, ensuring a smooth process. Furthermore, we offer insights into top-rated Pflugerville lenders based on customer reviews and comparisons.

- Understanding Pflugerville Auto Title Loans: Basics Explained

- Factors to Consider When Choosing a Lender

- Top Pflugerville Lenders: Reviews and Comparison Insights

Understanding Pflugerville Auto Title Loans: Basics Explained

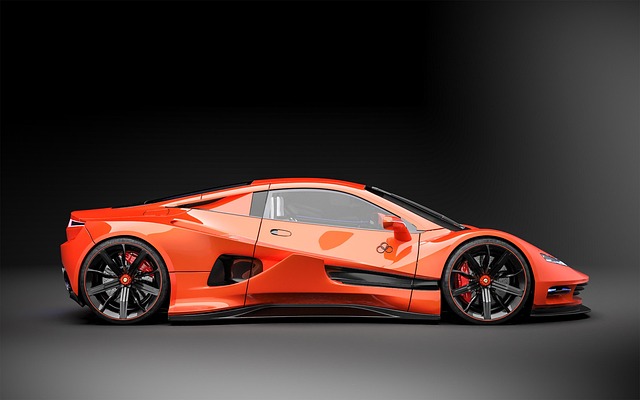

Pflugerville auto title loans are a type of secured loan where the borrower uses their vehicle’s title as collateral. This unique financial product allows individuals to access cash by leveraging the value of their car, truck, or motorcycle. Unlike traditional loans that require strict credit checks, these loans focus more on the vehicle’s equity rather than the borrower’s credit score. It’s an attractive option for those in need of quick funding and who own a vehicle with substantial equity.

When considering a Pflugerville auto title loan, borrowers can expect flexible payment plans tailored to their financial comfort zones. The process is straightforward; you hand over your vehicle’s title as security, and once the loan is repaid, the title is returned. Additionally, many lenders offer the option of loan refinancing, allowing borrowers to adjust terms if their circumstances change or if they’d like to lower monthly payments. Keep Your Vehicle remains a key principle, ensuring that borrowers retain possession of their automotive assets throughout the loan period.

Factors to Consider When Choosing a Lender

When selecting a lender for Pflugerville auto title loans, several factors come into play to ensure you get the best deal. Firstly, consider the interest rates and terms offered. Different lenders will have varying repayment periods and interest calculation methods, so understanding these terms is crucial for managing your loan effectively. Look for transparent pricing with no hidden fees.

Additionally, the availability of flexible payment plans is an essential consideration. Some lenders provide tailored options to suit individual needs, allowing borrowers to choose a schedule that aligns with their financial capabilities. Moreover, while a credit check is typical for most loans, it’s beneficial to explore lenders who offer alternatives or have less stringent requirements, especially if you’re in urgent need of emergency funding.

Top Pflugerville Lenders: Reviews and Comparison Insights

When exploring Pflugerville auto title loans, it’s essential to consider reputable lenders known for their transparency and customer-centric services. Two top options stand out in the competitive landscape of Texas: Lender A and Lender B. Both have garnered positive reviews for their streamlined processes and flexible terms, but each offers unique advantages.

Lender A is renowned for its swift approval times, often facilitating fast cash disbursal within 24 hours of application. Their online platform makes it convenient to check eligibility and apply from the comfort of your home. On the other hand, Lender B distinguishes itself by allowing borrowers to keep their vehicles during the loan period, which is a significant advantage for those reliant on their cars for daily activities. Comparatively, Dallas title loans often come with longer repayment periods, but these Pflugerville lenders offer competitive rates and terms tailored to local drivers’ needs.

When it comes to securing a loan in Pflugerville, understanding your options is key. Pflugerville auto title loans offer a unique opportunity for those seeking quick cash. By leveraging the equity in your vehicle, you can gain access to funds without the strict requirements of traditional loans. When choosing a lender, consider factors like interest rates, repayment terms, and customer reviews. After reviewing top lenders in Pflugerville, compare their services to find the best fit for your needs. Make an informed decision based on your research and ensure you work with a reputable lender to receive the most favorable terms for your Pflugerville auto title loan.